What’s that popular phrase… “There’s more than one way to skin a cat?” We don’t know what mad animal-sogynist came up with that one, but the underlying message has relevance—when it comes to nonprofits, there’s more than one type of impactful donation. There’s the monetary kind that organizations receive in the form of grants, major gifts, sponsorships, and individual donations. And then there’s the type of donation that can have just as much value for nonprofits—in-kind donations.

We’re going in-depth into the world of in-kind donations and providing an overview, best practices, and do’s + don’ts that should be on every nonprofit’s radar.

What’s an in-kind donation?

Let’s start with a basic definition: in-kind donations are non-cash donations bestowed to nonprofits by donors, corporations, sponsors, etc. This type of donation comes in the form of goods or services. Even though in-kind donations aren’t in the form of dollars and cents, they still carry a monetary value that nonprofits must report. But we’re getting ahead of ourselves. First, here’s a general breakdown of the two major types of in-kind donations:

In-kind goods

Donated in-kind goods include items such as gift baskets, electronic devices, gardening supplies, toiletries, blankets, diapers, used clothing, pharmaceuticals, and sporting tickets, just to name a few. Basically, any tangible item under the sun that isn’t money can be considered in-kind if donated to a nonprofit.

In-kind services

Donated in-kind services include services provided by vendors, small businesses, consultants, professional service providers, etc. Services can include transportation, website development, graphic design, legal aid, accounting, marketing, and more. These services can be donated and performed by the donor, or a donor or business can purchase a service for the nonprofit to use at their leisure.

For example, a donor may pay $500 directly to a printer who will then provide services for a nonprofit’s marketing materials promoting an upcoming fundraising event. Or, a lawyer may provide up to 10 hours of legal services to a social services nonprofit that helps victims of domestic violence. Both fall under the umbrella of donated in-kind services.

Why and how can nonprofits use in-kind donations?

Every nonprofit can benefit from in-kind donations. If you’ve ever tried to get a general operating grant, you already know how crucial it is that you have funds to maintain the day-to-day operations of a nonprofit. That’s where in-kind donations can really shine. Instead of spending money on new technology and computers, what if a generous donor offered new laptops to your organization? That could save your nonprofit thousands of dollars. If your nonprofit runs after school programs, how valuable would donated educational supplies be? Sure, cash is always preferred, but if you can get donated items that you’d have to otherwise purchase, that leaves more money on the table for your nonprofit to fund mission-critical projects and programs.

Another great use of in-kind donations is fundraising events. They’re supposed to bring in money, but in the planning stages especially, nonprofit events can get pretty darn expensive. Finding ways to offset costs can go a long way toward making your fundraising a reality. Oh, a donor wants to donate 100 glass vases to your nonprofit? Great! Use those as centerpieces for your gala, then pay it forward and let guests take them home after the event. Voila, money saved.

How can nonprofits secure in-kind donations?

Now that you know why in-kind donations are important and how your nonprofit can put them to good use, how the heck do you secure them? We want to let you in on a little secret, nonprofit friend—just ask. We’ll give you a second to process that…

Okay, now that you’re composed, here’s the deal. We prefer to keep things simple. If your nonprofit is in need, assign a person in your organization to be in charge of securing in-kind donations. A few hours of outreach a month can make a huge difference. The key is making your ask specific and asking the right people.

Your board is also another wonderful resource for in-kind donations. Board members oftentimes have access to enterprise-level companies—those companies always need to unload tickets, gifts, electronics, etc.

What’s the best way to keep track of in-kind donations?

Pop quiz: once all those in-kind donations start rolling in, what’s the best way to track and manage them? If you answered a spreadsheet, please see yourself to the principal’s office…

Everyone else who answered “Nonprofit CRM” gets a gold star!

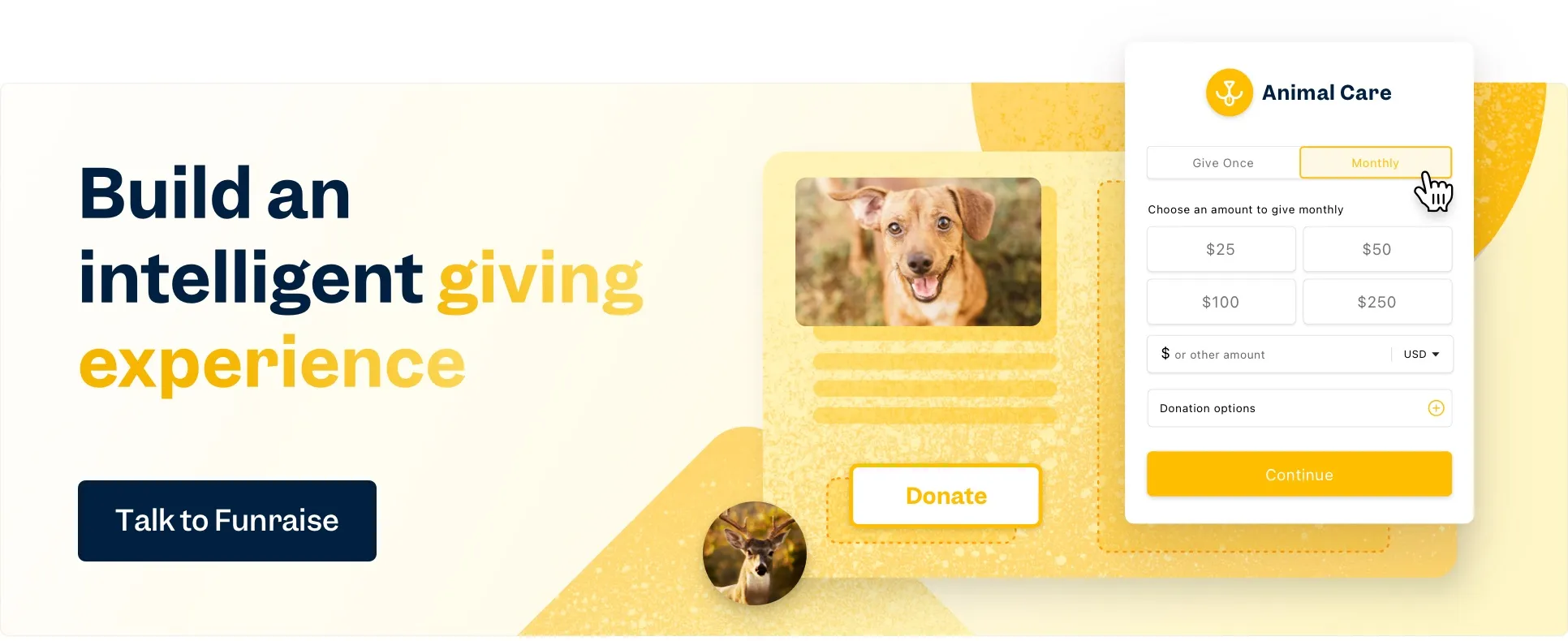

If you want a smart and simple way to track in-kind donations, a nonprofit CRM is your best bet. Using a sophisticated donor CRM (like Funraise’s), you can easily track and manage all your org’s in-kind donations just like you manage all your other offline donations (such as checks and cash).

By taking this route, you’ll be able to manage all your in-kind donations the same way you manage your online donations, including running reports filtered by donor, donation amount, frequency, etc.

We understand how ingrained spreadsheet life is for some nonprofits, but there’s a better way! And that yellow brick road is designed to simplify your job and give you more time for strategic, mission-related tasks (which shouldn’t include time-sucking spreadsheet analyses).

What are the benefits and risks of accepting in-kind donations?

Just like most things, there are benefits and risks to nonprofits accepting in-kind donations. Here are just a few points to keep in mind.

Benefits of accepting in-kind donations

- Alleviates project and program cost leaving more money for operations-related expenses

- Provides value to orgs whose missions are tied to goods (after school programs, homeless services, etc.)

- Reduces cost-to-constituent for goods-reliant programs and services

- Raises more funds via silent auctions, raffles, etc.

Risks of accepting in-kind donations

- Donations may require too many internal resources to manage (real estate, stocks, etc.)

- Donations may not align with the nonprofit’s mission, vision, or values

- Donation may be tied to too many restrictions

How should nonprofits acknowledge in-kind donations?

Once your nonprofit accepts an in-kind donation, make sure the donor is properly acknowledged and thanked. You know how you send thank you letters and acknowledgments to your donors after they’ve donated money? The same process applies to in-kind donations. In addition to providing a proper acknowledgment that includes tax-deductible information, delight your donors with a genuine thank you.

Continue to nurture that donor relationship like you would a cash donor so they’ll be more inclined to give again and hopefully donate on a regular basis.

In-kind donation do’s and don’ts

We’ll leave you with do’s and don’t of in-kind donations for nonprofits.

In-kind donation do’s (isn’t that fun to say?)

In-kind donation don’ts (still kind of fun to say.)

If your nonprofit is new to accepting in-kind donations, we recommend checking in with your accounting and/or legal department to ensure you’re properly recording your in-kind donations, just to be on the safe side. Tax surprises are rarely fun surprises.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)