There are a lot of payment processors out there these days, and everyone seems to have their favorite. This can create a minor headache for nonprofits as fundraising teams juggle various integrations, check for the latest updates, and track the ever-changing fee structures. Now, Venmo, a mobile payment service app, has joined the conversation—and it's in a class of its own. “I'll Venmo you” has entered our common parlance, and most of us have wasted at least a few minutes scrolling through Venmo feeds, interpreting what various emojis mean in terms of reimbursements. (And we've carefully coded our own emoji messages for brunches, dog sitting, and takeout!)

Venmo has been around since 2009, so it's hardly new. It's only in the past few years, however, that it's gained a substantial foothold in the digital wallet market. And it's only in 2022 that parent company PayPal introduced benefits tailored for nonprofit fundraising efforts.

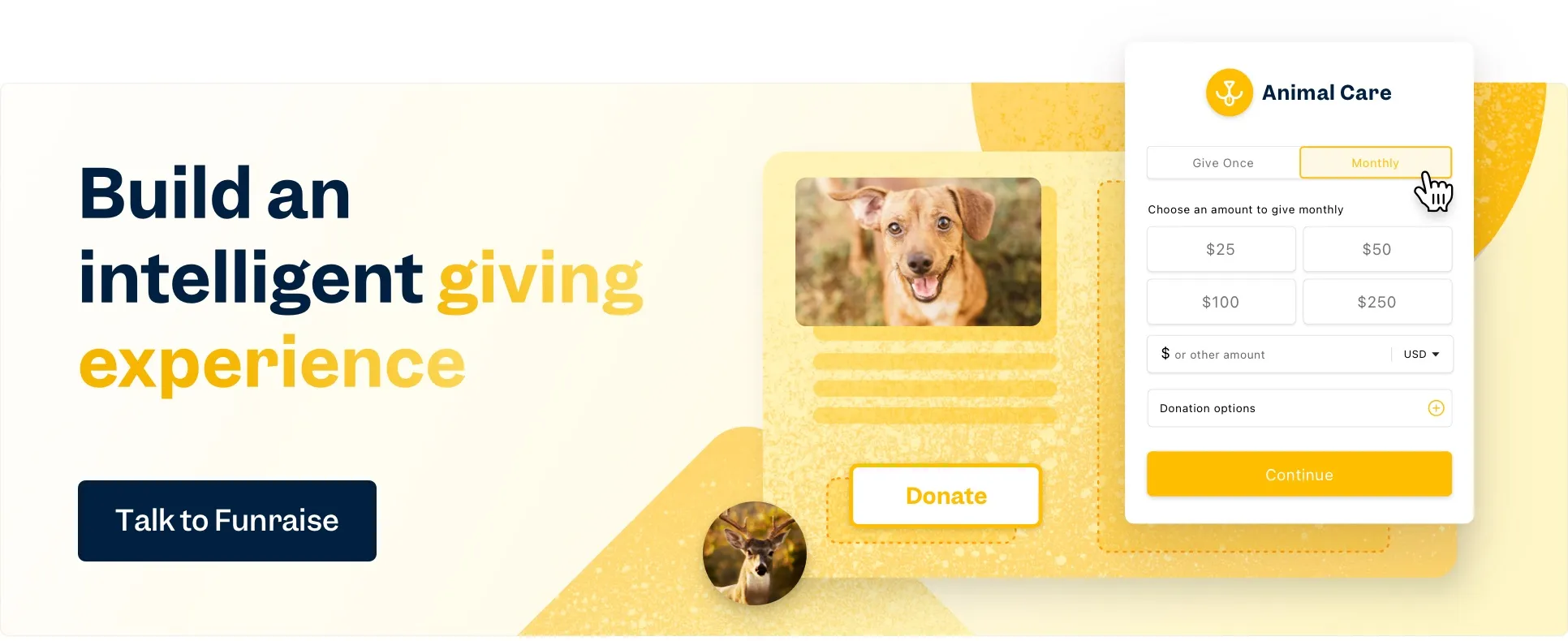

So, in honor of these changes—and Funraise's shiny donation forms, which make accepting and tracking Venmo payments a breeze—we're exploring the Venmo landscape for nonprofits. As a nonprofit organization, here's what you need to know about Venmo as the future becomes the present.

How Venmo works

A quick refresher on Venmo's raison d'être: the mostly-mobile peer-to-peer payment method can be used to send, request, and receive payments. Users download the app on their phone, make an account, and then link it to their bank accounts. Then, they can pay people using their credit or debit card or pay directly from their Venmo stockpile. When they reimburse a friend for that kale smoothie, they can share their payment far and wide, making everyone think, “My life is empty; I should really drink more kale smoothies!” Or they can donate to a fundraiser and make everyone think, “I should stop buying so many kale smoothies and donate to a good cause!”

This is where you come in, nonprofiteer.

How to use Venmo as a nonprofit

In the world of apps, nothing stays the same for long, so you can bet your bottom dollar that Venmo's nonprofit tools will continue to shift in the months and years ahead. Still, here's your snapshot of how to use Venmo for nonprofits as they expand their offerings for charities.

Full transparency disclaimer: For a number of years, Venmo wasn't a great choice for charitable donations. There were transaction limits and a whole lot of fraud, and getting back money was a real pain in the tuchus. Today, however, things are changing, and Venmo is a convenient, secure option for mobile donations.

Now, you can easily connect Venmo to your super-secure Funraise account and accept donations in one click. If you want the nitty-gritty details, you can read our complete play-by-play on how to accept Venmo donations with Funraise. Spoiler alert: it's pretty darn simple. Because Venmo is a PayPal product, you'll get access to Venmo automatically if your Funraise account is already set up with PayPal. And, you'll be able to view all Venmo payments in your PayPal account. You know we like to make things easy ;)

In addition to providing an additional payment option for donors, Venmo recently (as in, since October 2022) began offering charity-specific benefits through their charity profiles. Similar to Venmo's business profiles, charity profiles offer registered nonprofits various tools and benefits—but they also come with a few drawbacks. Wondering if you should sign up or not? Read on.

What we know (so far) about Venmo charity profiles

Today, any nonprofit organization can create a charitable profile on Venmo. Once you're all signed up, you'll be added to Venmo's list of registered charities. That means when Venmo users tap the search bar and access the app's new “make a donation” option, they'll be able to find your name and donate as they see fit.

While that's all well and good, the choice of whether to use charity profiles isn't as clear-cut as it first appears. This is a brand-new feature, and as such, Venmo's still working out some kinks. As a result, there are pros and cons to charity profiles. Here's your primer:

Benefits of Venmo charity profiles

You get...

- a (blue check) verification badge to show donors that you’re legit.

- increased visibility on Venmo through the charitable search feature and user options to share recent donations with their network.

- no set-up or monthly fees (transaction fees are 1.9% + $0.10 for every donation).

- donation history and account statements, with basic donor contact information.

- the ability to create a photo gallery for your nonprofit.

- a unique QR code and QR kit (with a wallet card + lanyard, tabletop display with stand, and five stickers) for contactless payment at in-person events.

Drawbacks of Venmo charity profiles

- Venmo places a limit on user transactions as well as organization bank transfers. As of December 2022, there’s a $100,000 weekly rolling limit on standard transfers to a bank account as well as a $50,000 weekly rolling limit on instant transfers to a bank account or debit card.

- While you’ll have same-day access to funds from donations, Venmo charges an additional fee to transfer funds instantly.

- There’s no recurring giving option.

- Venmo doesn’t generate and send tax receipts automatically.

- Charity profiles don’t integrate with your donor CRM. While you’ll receive donor names and email addresses, you won’t get addresses, phone numbers, or any demographic information.

- Venmo doesn't offer a Donors Cover Fees model to cover transaction fees. Your charity pays it all.

Venmo Business vs. Venmo Charity Profiles

There are a few key differences between Venmo Business Profiles and Venmo Charity Profiles. Both have benefits, so take a look and choose carefully, because when it comes to your nonprofit, there can only be one.

1. Venmo business profiles have a tipping option you can turn on. In theory, that could be a way for you to get donors to cover your transaction fees. Venmo charity profiles do not allow tipping, which means your organization will cover the fees.

2. Business transactions qualify for Venmo Purchase Protection. While you can process a refund for a donation with Venmo's help, you'll still have to cover the processing fee, and your donors won't see the "Eligible items covered by Purchase Protection" note when they give. On the other hand, verified charity profiles get a blue check badge confirming their legitimacy. Business profiles do not.

3. Venmo charity profiles are set up to receive donations only—they cannot make payments. If you need to make a payment via Venmo, you'll have to toggle to the connected personal account. Business accounts, on the other hand, can make payments up to $25,000 per week.

4. Verified Venmo charity profiles can make standard transfers of up to $100,000 per week to their bank. Verified business accounts can only make standard transfers up to $50,000.

How do you sign up for Venmo charity profiles?

If you’re considering signing up for charity profiles after weighing the pros and cons, here’s some good news: it’s a snap! All you need to do is confirm your official charity status with PayPal, Venmo’s parent company—and most nonprofits have already done that. Then, you create a Venmo account or sign in if you already have one. Fill out some basic info (most of it will be imported from PayPal), preview the profile to check for any errors, and voila!

A couple of caveats: you can’t convert an existing business profile to a charity profile. Also, remember that you need a mobile number,not just an email address, to create a Venmo account, and you won’t be able to create a second account with a single phone number. Finally, you won’t be able to edit your charity profile on a laptop or desktop computer—it’s an app, and that means it’s mobile-first.

Since you should always try to get your info from the original source, we've looped Venmo in to provide the most updated guidance.

Direct from help.Venmo: How can I create a charity profile?

First, navigate to PayPal's Business Tools page for charity profiles or search for Venmo in your Business Tools. Then, select "Get Started".

If you're already a PayPal Charity, we'll bring you over to Venmo to sign up for a new account or sign in if you already have a Venmo account.

If you're creating a new account, you'll need to enter and verify your mobile phone number by following the prompts on your screen. Then, choose an email address and password for your account and agree to Venmo's terms and conditions.

Next, we'll gather your information from PayPal to start creating your Venmo charity profile. Here's what you'll need to do:

Enter a username, description, category, and keywords to help donors find your charity profile

Enter your contact information and provide any social media or website links you wish to include on your profile

Preview your charity profile and tap “Publish”

Do I need a Venmo account to sign up?

Nope. In fact, if you already have a Venmo account, you'll need to create a new one—an existing account can't be converted to a charity profile.

Do I need a PayPal account to get a Venmo charity profile?

Yep. Nonprofits need a PayPal business account in order to set up a charity profile on Venmo. Seems weird, right? To get a Venmo charity account, you can't have a Venmo account, but you must have a PayPal account. If you think that's bizarre, you need to watch Black Mirror.

What if I already have a Venmo account?

You can't convert an existing personal or business profile into a charity profile on Venmo—at least not unless you're living in the future! You also can't use your contact info on more than one Venmo account. While you can use Venmo to create a charity profile by using a new email address and phone number, you'll still need a PayPal business account.

What if I have a Venmo business account?

There isn't a way to convert an existing business profile into a charity profile or to use your contact information on more than one Venmo account. There just isn't. If you have to use a contact phone number and email address that's already connected to a Venmo account, contact help.Venmo for assistance closing your current account and starting over.

So, to charity profile or not to charity profile? Ultimately, the choice is yours, but many nonprofits may find that simply offering Venmo as a payment option is the way to go—at least for now. We’ll keep you updated as Venmo changes its giving tools and benefits.

Why use Venmo for your nonprofit

And now we get to the (tofu) meat of the issue: Why should nonprofits care about Venmo in the first place? We’re so glad you asked. There are plenty of reasons to jump on the Venmo bandwagon.

1. Access a huge user network.

As of mid-2022, there are over 77 million Venmo users in the US. Estimates put 2021 usage at around 70 million, 2020 usage at 63 million, and 2019 usage at 41.5 million (Oberlo). That’s an impressive 10.8% increase from 2021 to 2022. While that level of growth might level off, forecasts still show a reliable increase in users over the next few years. Who wouldn’t want to be a part of that?

2. The younger generations love it.

Adults under 50 are much more likely to use payment apps than older adults, and they especially love Venmo. According to Pew Research, more than half (57%) of 18- to 29-year-olds report using Venmo, compared with 49% of those ages 30 to 49. For comparison, just 28% of 50- to 64-year-olds use it, and that percentage drops to 15% for ages 65+. So, if you’re looking to reach younger donors (or, for that matter, older donors who want to be hip), Venmo is a natural choice.

3. Social proof is the great convincer.

Venmo’s big differentiator—and a key reason that young people love it—is its social feed, which allows you to see what everyone’s spending their Venmo funds on. Not only does this provide free advertising for your org, but it could convert some new donors, too. A decade ago, Nielsen found that 92% of consumers trust recommendations from their friends and family over other forms of marketing—and that’s still true today. So, when someone donates and all their Venmo buddies see it, chances are they’ll consider if they, too, should be giving back.

4. Amazon is getting in on it.

Want some proof that Venmo’s the next big thing? This October, Amazon announced that users will be able to pay through Venmo; the feature went live on Black Friday. (What a coincidence!)

5. It’s super user-friendly.

Once you’ve created a Venmo account and linked it to your bank account, you can pay with a click. The app already knows all your information, so there’s no need to reenter information. And because it’s a mobile app, you can use it anywhere, at any time.

6. Reasonable fees.

Once you’ve confirmed your charity designation, transaction fees are 1.9% + $0.10 for every donation received—the same fees that Venmo charges businesses.

7. Spontaneous spending.

Most Venmo users keep some funds in their actual Venmo account, as opposed to in their bank account, so they can easily pay back friends and family. That money’s just sitting there, lending itself to spur-of-the-moment spending—or donating. No need to double-click your iPhone button or enter a code.

8. Get to know your donors.

Because Venmo is also a social app, folks can send a message alongside their donations, giving you the opportunity to start a dialogue from day one. You can send an instant thank you when you get a donation, and you can follow up with a personalized message to learn more about your new donor’s preferences.

9. Have some fun.

One thing about Venmo that everyone loves? It makes payments fun! Deciding which emojis to use is delightful, and interpreting what your friends are paying for is even delightful-er. (If your nonprofit lends itself to emojis, this may be the perfect time to create your own emoji formula!)

How to reach donors on Venmo

If you’re totally on the Venmo bandwagon, you probably have one more question: “How do I get donors to use Venmo?” We’re so glad you asked!

1. Make it an option.

First, be sure to enable Venmo on your donation forms. You can do this in your Funraise account, and then watch the donations roll in.

2. Teach donors the way.

People are always a bit anxious when it comes to change, so help your donors learn the ways of Venmo. Create a PDF guide, write a blog post, or make a short video explaining the ins and outs of donating via Venmo.

3. Use your Venmo QR code.

At your next fundraising event, give attendees the option of paying with Venmo. Put your QR code in your window. Share stickers (Venmo will send you five to start in a QR kit). Display it everywhere! By promoting your QR code, you’ll build supporters’ awareness that Venmo’s an option.

4. Tailor your strategy

Younger donors are much more likely to use Venmo, so kick things off by advertising to them. To start, share your Venmo info on social platforms frequented by younger users, like TikTok. You can create some videos and shout it from the rooftops, or you can just add your Venmo handle to your TikTok bio. And because Venmo’s a mobile app, don’t forget to feature it widely in text campaigns.

5. Think small.

Venmo’s more about small transactions than big purchases, so keep that in mind. Rather than going after major gifts, focus on bringing in lots of new donors with small ones. Once you’ve made a connection and established a relationship, you can up your ask.

Alternatives to Venmo

If you’re not feeling the Venmo love—or just want to know what else is out there, here are some of the major Venmo alternatives.

- PayPal. You know it, you (maybe? Hopefully?) love it, and it actually owns Venmo.

- Zelle. Many folks are already well acquainted with Zelle due to its partnership with most major banks.

- Apple Pay. If you’ve got an iPhone, you’ve got Apple Pay, making it extra-user-friendly …unless you have an Android.

- Cash App. TBH, it’s quite similar to Venmo, but without the social features. PayPal owns Venmo; Block (formerly Square) owns Cash App.

- Google Pay. It integrates with a lot of other apps, like Airbnb and DoorDash, which is handy.

In the end, Venmo is user-friendly, convenient, and fun. Plus, you’ll have one more payment option, which means more choices for your donors—and that’s good for everyone.

Nonprofits and Venmo: FAQs

Are PayPal and Venmo the same?

PayPal owns Venmo, and the two products certainly have a lot in common. Still, they’re not the exact same product. The primary difference with Venmo is that you have your own social feed through which you can share payment details and view friends’ payments.

Is Venmo safe for donors?

Venmo uses data encryption technology to protect account information, which means no one else can access your credit card or bank account. Having said that, account holders are vulnerable in the same way any finance app is exposed, so encourage donors to use Venmo with the same caution that they would with any other online payment platform.

Is Venmo available outside the US?

Unfortunately, Venmo isn’t supported abroad. That means no international donors, and folks can’t use it while traveling outside the United States.

Does Venmo charge a fee for nonprofits?

Venmo transaction fees for charities are 1.9% + $0.10 for every donation received—the same fees that Venmo charges businesses.

How popular is Venmo?

When your product's name becomes a verb, you know you're onto something. (We'll wait while you change your email signature to "Funraiser".) Although Venmo's been around since 2009, its popularity and usage has blown up since 2016, with over 40 million unique users in 2019. But it doesn't stop there: by 2021, over 70 million people had Venmo accounts.

The big question is whether people actually use it. And with $159 billion in total payment volume in 2020, and $230 billion in 2021, we'd say yeah. Yeah, Venmo's pretty darn popular.

Who can create a charity profile?

Straight from the source: "Venmo charity profiles are available for charitable organizations and 501(c)3s that have created an account and confirmed their charity status with our parent company, PayPal. By confirming your charity status with PayPal, you'll gain the ability to create a charity profile on Venmo and collect donations from an engaged community of donors on our platform."

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)