Nonprofit payment processing key takeaways

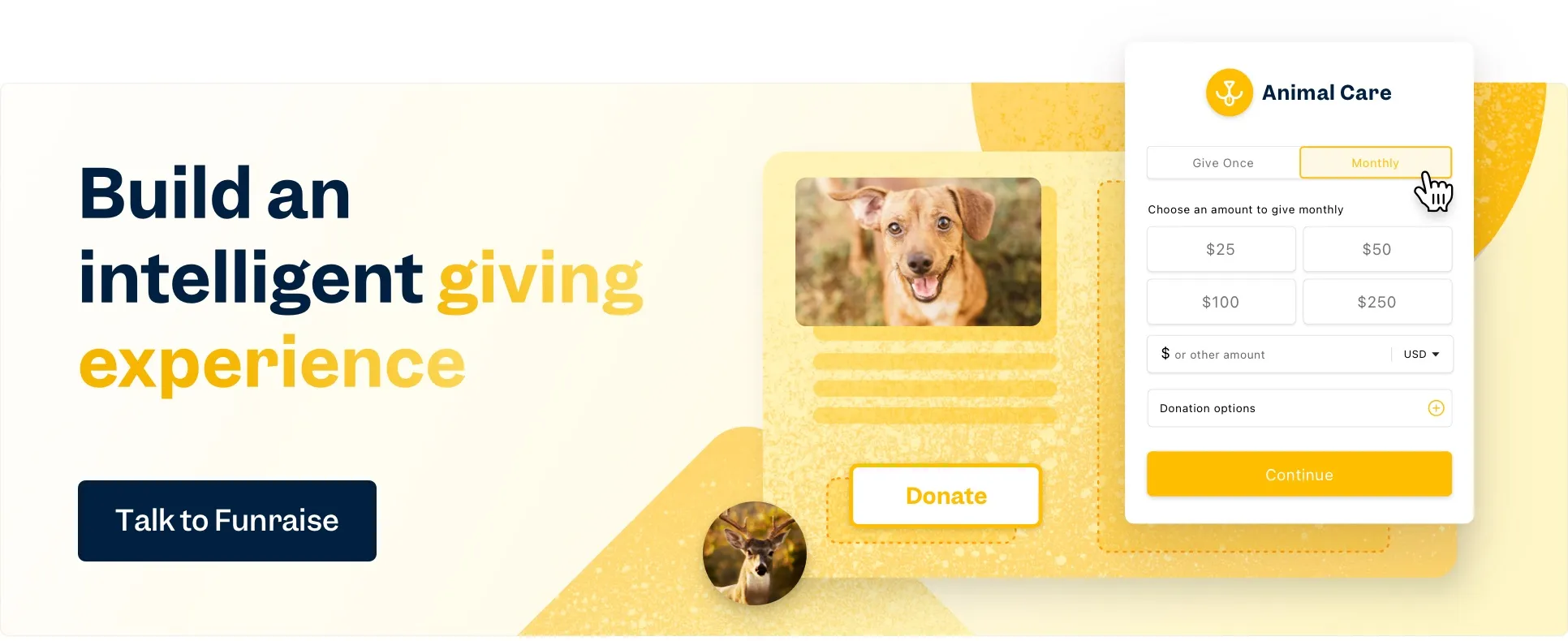

- Funraise Payments is powered by Stripe and is purpose-built for nonprofit donation processing. It offers the best of Stripe and Funraise's security, innovation, and ease of use. All Funraise accounts have access to this super-powered payment processor. So, what are you waiting for?

- With more than four in five Americans using digital payments, qualified nonprofits need to work with payment processing companies to accept and process online payments securely and seamlessly. Payment processors also make accepting credit card payments safe and secure.

- There are three main fee types associated with payment processors: transaction fees, flat fees, and incidental fees.

- When you select payment processors, security is paramount. Look for a processor that is PCI-compliant and uses tokenization and encryption to protect donor information.

- The right payment processor depends on your qualified nonprofit's size, technical knowledge, and needs.

Donation Form Payment Processing FAQ

Do nonprofits have to pay credit card processing fees?

Short answer: Yes. The longer answer is generally yes, but there are nuances involved that can affect how these fees for credit card processing for nonprofits impact the organization. For example, models like Funraise's Donors Cover Fees ensure that while nonprofits are still charged at their standard nonprofit rate, the donation will cover much of these fees.

What's the difference between an online donation tool and a payment processor?

Online fundraising software and digital donation tools are the housing for the payment gateway and the payment processor. Rather than asking how they're different, it's more useful to look at them as two parts of a machine or process. They fulfill different roles and come into play at different times during the donation process.

What type of security should I look for?

When it comes to payment processing solutions, ensuring the security of your donation forms is paramount. Donors need to feel confident that their personal and financial information will be protected throughout the transaction process. Look at Funraise's donation form security to set a benchmark for the type of data security your nonprofit needs.

Which payment method is best when donating to a charity?

Charities want you to be able to make a gift in the way that makes the most sense and is the most efficient for you, dear donor. If you want to ensure that you're doing your best each month for nonprofits, opt in to cover the costs of processing for nonprofits or platform fees.

Which payment gateway is best for nonprofits?

Funraise Payments, powered by Stripe, is the best payment gateway for nonprofits. Funraise Payments combines the power and innovation of Stripe with Funraise's incredible product and nonprofit industry knowledge. Funraise Payments is built for non-profit organizations just like yours, employs bank-level security measures, and is baked in to the best fundraising software in the galaxy.

What is the safest way to donate money?

The safest way to donate money is to use a trusted payment gateway on a donation form that clearly advertises the payment processor that powers it. To only give money to trusted nonprofit organizations, to trust your instinct, and to never give more than you can afford.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)